georgia ad valorem tax rv

You only pay this tax one time. Georgia is exempt from sales and use tax and the annual ad valorem tax also known as the birthday tax These taxes are replaced by a one-time tax called the title ad valorem tax fee TAVT.

In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later.

. The TAVT is collected by the county tax commissioner before a new title is issued and the vehicle is. Instead these vehicles will be subject to a new one-time title ad valorem tax that is based on the value of the vehicle. This calculator can estimate the tax due when you buy a vehicle.

RV sales tax ad valorem is actually 7. Some states like Massachusetts and Georgia apply a use tax to cars boats and RVs. I didnt think much about it since it was new.

It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership is transferred. Title Ad Valorem Tax Estimator calculator Get the estimated TAVT tax based on the value of the vehicle. You pay it upfront when you get your tags but its deductible on your Schedule A.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. When registering a RV in Georgia be prepared to pay the total ad valorem tax up front. Before sharing sensitive or personal information make sure youre on an official state website.

Last year the Ad Valorem Tax on the Solitude was 58656. Title Ad Valorem Tax TAVT became effective on March 1 2013. Ad Valorem Tax.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. Tax Credits X Motor Vehicles Online Services Titles and Registration TAVT Annual Ad Valorem Specialty License Plates Dealers Insurance Customer Service Operations Georgia Trucking Portal Forms X Alcohol Tobacco. We have since relocated up to Georgia and brought the RV with us.

This tax is based on the value of the vehicle. TAVT is calculated at a rate of 675 of the vehicles value not the sales price as defined by the. When we moved to Georgia from Florida we found out about the ad valorem tax.

Local state and federal government websites often end in gov. Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. Get the estimated TAVT tax based on the value of the vehicle using.

You can use DRIVES e-Services to determine the amount due. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to.

If you have a lienholder. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. The TAVT rate will be lowered to 66 of the fair market value.

At a market value of 60k-80k that means 4200 - 5600 out of pocket on a vehicle weve already paid sales tax for. Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax. Having done this we just went get our 2000 tag and were hit with 5000 Highway Impact fee which will be an annual fee.

Georgia Department of Revenue. Taking a standard deduction. As of 2018 residents in most Georgia counties pay a one-time 7 percent ad valorem tax on these vehicles at the time of purchase.

The two changes that apply to most vehicle transactions are. Department of Revenues motor vehicle ad valorem assessment manual. This morning when the young lady said 66536 I almost died.

Dealerships will be required. We paid our titletagtaxes when we returned to Georgia but I just received a bill for ad valorem taxes today. It has to fit into the same 10000 limit as your sales tax but if it does youll want to take it.

If you are a new Georgia resident you are required to pay a one-time title ad valorem tax title tax of 3. Vehicles purchased through a private sale non-dealer sale that were previously exempt from sales tax are now. The law readsHighway Impact Fees - all vehicles in the following weight classes will a.

In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles purchased or sold on or after January 1 2020. I was surprised since I thought the vehicle taxes were a one-time tax. TAVT is a one-time tax that is paid at the time the vehicle is titled.

The Georgia title will be issued to the lienholder on file. Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT. The full amount is due upon titling any motor vehicle.

Use Ad Valorem Tax Calculator. In addition if you purchase and title a vehicle between January 1 2012 and March 1 2013 you may be eligible to opt-in to the new title ad valorem tax. RVs and Motorhomes To register title and tag your RV camper or motor home complete a Motor Vehicle TitleTag Application Form MV-1 and apply at your local tag office.

Read more and use the calculators at. When I called the office I was told that there is now an annual ad valorem tax since the vehicle is towed not motorized. Return the completed form to your county Tax Commissioners tag office and you will be issued a license plate and Georgia registration certificate.

Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie. Depending on how long you have owned your RV and how long it has been registered and titled in another state in your name will determine how much you have to pay with the one time ad-valorem tax TAVT on your RV when you register it in Georgia. Georgia Listed As A Tax Friendly State For Retirees The New Title Ad Valorem Tax Tavt In Simple Terms Lake Lanier Georgia Used Car Sales Tax Fees 2 Motor Vehicle Division Georgia Department Of Revenue 47605 Yale Road Chilliwack Bc V2p 7m8 First Time Home Buyers Bright Living Room Beautiful Homes Title Ad Valorem Tax Tavt.

All the cars and motor home have this fee each year. Its based on the value of the vehicle. Since June is my birth month I made my annual trip to the County Tax Office this morning to renew the tags on all my vehicles including our Solitude.

Ad valorem tax or use tax deduction. We thought taxes would be cheaper in Georgia but we were wrong. I guess since the rv is based in Georgia youre getting the charge.

Problem is theres a 7 ad valorem tax that will be assessed on our RV when we register it based on fair market value.

Motor Vehicle Division Georgia Department Of Revenue

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Georgia Listed As A Tax Friendly State For Retirees

Motor Vehicle Division Georgia Department Of Revenue

Georgia State Veteran Benefits Military Com

Georgia Motor Vehicle Ad Valorem Assessment Manual

Georgia Used Car Sales Tax Fees

Motor Vehicles Forsyth County Tax

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

The New Title Ad Valorem Tax Tavt In Simple Terms Lake Lanier

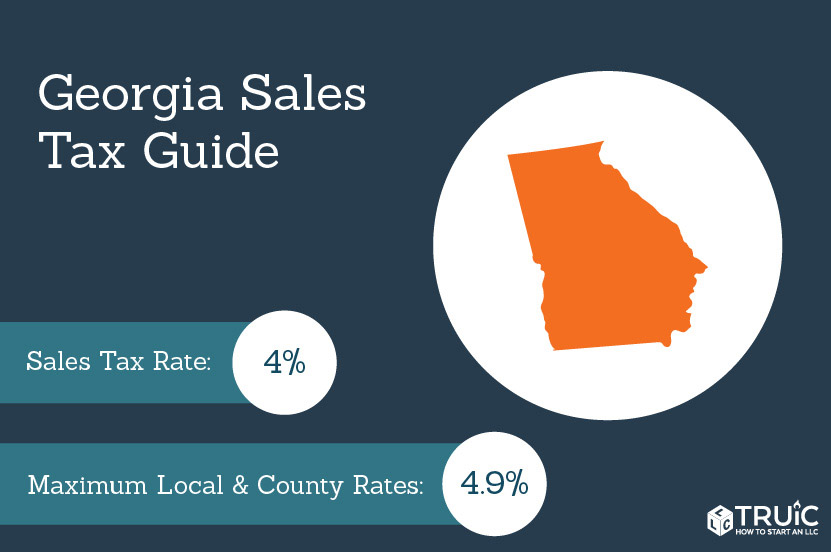

Georgia Sales Tax Small Business Guide Truic

![]()

Georgia New Car Sales Tax Calculator

Vehicle Taxes Dekalb Tax Commissioner

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price